Quantitative & Qualitative Forecasting Techniques For Your Supply Chain

Did you know? Last year, global eCommerce sales crossed 4.2 trillion US dollars and are expected to rise to 5.4 trillion US dollars by next year.

To stay relevant in a market this big and to cater to the increasing demand, it is important to understand how to properly forecast your supply chain. Keeping your supply chain on-track results in stronger business relationships, better customer experience, and more capital to scale your business.

However, forecasting your supply accurately based on your historical data can be difficult at times. You, as a result, end up feeling worried and under-prepared for what’s coming your way.

This is why it is crucial to know about the different quantitative and qualitative forecasting techniques & how you can use them to optimize your supply chain.

What Is Supply Chain Forecasting?

Supply chain forecasting refers to the process of predicting everything about your supply chain to ensure smooth running and continued growth. This is done using various data points and research methods.

Supply chain forecasting not just helps in demand forecasting and sales projections, but also makes it easy to determine production lead times, product pricing, labor needs, and others.

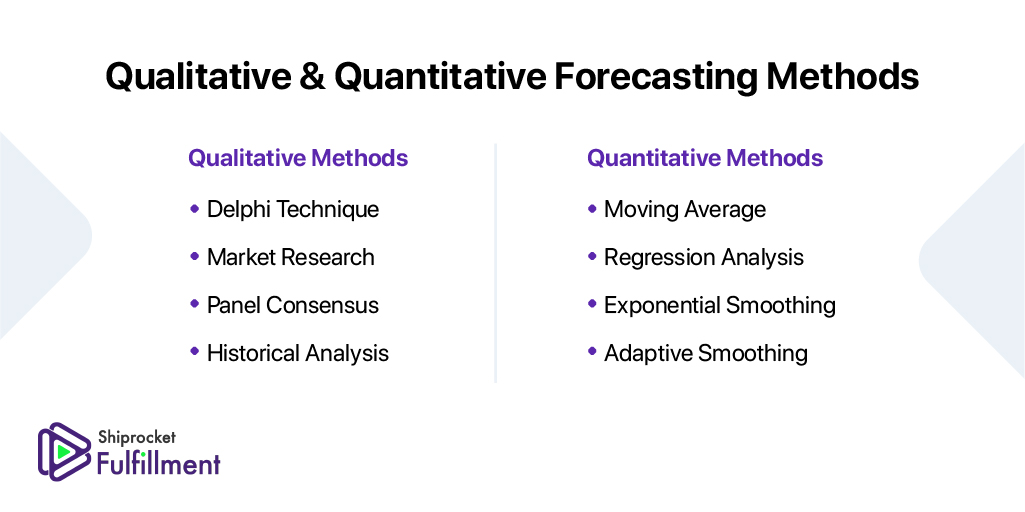

You can forecast your supply chain using two types of methods or techniques: quantitative and qualitative. Let’s understand the qualitative and quantitative forecasting methods in detail:

What Are Quantitative & Qualitative Forecasting Techniques?

Quantitative forecasting methods use past data to determine future outcomes. The formulas used to arrive at a value are entirely based on the assumption that the future will majorly imitate history.

On the other hand, the Qualitative forecasting method is primarily based on fresh data like surveys and interviews, industry benchmarks, and competitive analysis. This technique is useful for newly launched products, or verticals wherein historical data doesn’t exist yet.

Now that you know what qualitative and quantitative forecasting methods are, let’s deep dive further:

Qualitative Forecasting Methods

A business needs more than just sparing a glance at the previous data. The qualitative method of demand forecasting requires rigorous calculations. Below mentioned are a bunch of qualitative techniques that can prove helpful in the process:

Delphi method

In the Delphi method for qualitative demand forecasting, a panel of experts collectively give their opinions and answer questions regarding the same to other employees. The technique helps deal with bias as the firm interviews the experts individually to understand what they have to say about the forecast. Avoiding gathering information at once from the whole group ensures that the consensus and predictions come from the expert’s individual opinion and not from being influenced by other expert’s opinions. Once the experts lay their forecast information and thoughts, the rest of the employees pitch in and analyse the data. These employees then pose questions if necessary or accept a prediction if it suits the company.

Market Analysis and Research

As the name suggests, this technique involves analysing the market by conducting market research through customer testing. The company tests a small batch of the product on customers and observes their reaction to using it. There are two ways to conduct these market surveys; a company can take the help of their employees or tie up with an outside agency proficient in market research activities. Consumer surveys, focus groups, or blind product testing are some of the methods used to carry out market research, where consumers get their hands on the new product. When the product is unheard of by the customers, they try it without having any preconceived notions about it. The company then decides which products or services to go ahead with and which ones to discontinue in the production stage based on participants’ feedback and reactions.

Customer Surveys

A business conducts consumer surveys by asking for feedback from their customers about their experience. A company usually emails their customers the survey questionnaires or forms for a response. Another surveying method includes cold-calling the customers and having a small chit-chat to invite them to the office for a personal interview. The firm can then use this data collected from the customers to make informed decisions about improving their product or service. The employees can use these details to chalk out future business predictions, keeping their customers’ experiences in mind.

Expert Executive Opinion

This approach combines judgments of experts from the finance, sales, purchasing production, and other teams in an organisation. The executive opinion forecasting method is a collaborative effort. It ensures that the responsible team quickly completes the forecast while considering diverse perspectives from multiple departments to deliver a thoroughly informed forecast.

Salesforce Poll

The Salesforce polling method involves utilising internal resources to gain useful information about customer experiences. The method is quite simple since it only requires talking with the salesforce and using the information they provide. The firm collects relevant information from the sales staff in close contact with the customers and might have an inkling about how customers feel about the company’s products or services. Subsequently, the company selectively picks these sales buffs by ensuring they fetch this information from those frequently in touch with the business operations. It helps the business ascertain that they’re getting accurate and relevant.

Quantitative Forecasting Methods

Businesses frequently use quantitative methods of forecasting to predict future trends. These techniques usually depend on historical data and mathematical models for making informed predictions. It’s best to use quantitative forecasting methods when historical data and clearly defined relationships between variables are readily available. Let’s dive into the different types of quantitative forecasting techniques.

Regression Analysis Technique

This quantitative forecasting technique involves analysing an independent and a dependent variable and examining the relationship between them. By using the regression analysis method, a business can observe how both factors affect each other.

Let’s take an example of a finance analyst to understand this concept better. A Finance Analyst might want to understand how changes in interest rates impact the stock prices of companies in a particular industry. Here the stock prices of the company would be the dependent variable, and the independent one would be the fluctuations in interest rates. So, the analyst can quantify the relationship between interest rate movements and stock prices by applying the regression analysis technique. The insights extracted from this analysis can help financial institutions and investors in making more informed decisions about portfolio management, risk assessment, and investment strategies.

Index Number Technique

Businesses implement the index number method, also known as the barometric method, to analyse the status of the economy in different phases of time. This quantitative forecasting method is more suitable for short-term forecasting. The method provides a forecast that predicts the direction the economy is headed in the coming future. Such predictions help the business gain a deeper perspective into the rise and fall in demand as per the economic conditions locally and globally.

An excellent example of using the barometric method could be in the retail industry. Retailers usually require an in-depth view of economic indicators to anticipate changes in consumer spending patterns. It helps them to adjust their inventory levels and marketing strategies accordingly.

Let’s say a retail chain wants to forecast sales for the upcoming holiday season. They might prefer using the index number technique to scrutinise economic indicators such as consumer confidence indices, unemployment rates, housing market data, and retail sales reports from previous months. Examining these factors over several periods and calculating index numbers can help the retailer develop a forecast of future consumer demand.

So, supposedly, these economic indicators hint at a growing economy with increasing consumer confidence and falling unemployment rates. In that case, the retailer may predict higher sales volumes for the holiday season. However, the indicators may also imply downturns and instability in the economy. Then, the retailer may anticipate lower demand and adjust their inventory and promotional activities accordingly.

Econometrics Model Method

Developing mathematical equations to decipher the relationship among various economic factors is the essence of the econometrics model. Businesses can utilise the

information from this forecast and establish the connection between variables, like exchange rates, inflation, and GNP, and show how alterations in these factors impact the performance of the business.

For instance, a multinational corporation wants to analyse the impact of exchange rate fluctuations on a company’s profitability. The firm would naturally operate in several countries and may deal in import and export activities. So, it might be important for the company to understand how the changes in exchange rates may affect its financial performance. The firm can lay out an econometric model that includes variables such as exchange rates, sales revenues, production costs, and profits.

The econometric analysis will allow them to estimate the relationships between these variables and construct equations representing the dynamics of their business environment. For example, they may figure that a 1% increase in the exchange rate leads to a 0.5% decrease in profit margins due to higher import costs.

Owing to this insight, the business can make some informed decisions about pricing strategies and hedging against currency risks. They can further optimise their operations in response to changes in exchange rates. Moreover, the model also enables them to forecast future profitability under different scenarios of exchange rate movements, using and better managing their financial risks while maximising returns.

Input-output Analysis Method

This method, also called the end-use or IO technique, is more like ‘every action has an equal and opposite reaction’. It’s a form of quantitative economic research that shows a business how a particular input might shell out a specific output.

For example, economists can assess the economic impact of government investments in renewable energy infrastructure, such as wind energy projects, using the input-output analysis method. By factoring in the relationships between different sectors of the economy, including materials, labour, capital inputs and outputs like electricity generation, economists can estimate the direct, indirect, and induced effects of such investments. The policymakers get a fair idea of the overall economic benefits, job creation potential, and potential cost savings associated with transitioning to renewable energy sources with the valuable insights from this forecast.

Time series or Trend Analysis Method

Under the timer series method, companies forecast the demand by evaluating extensive historical data that assumes the past trends are going to continue and will repeat in the future. The technique evaluates trends, seasonal and cyclical changes, and irregular alterations in sales to define a particular pattern in the data. This method is usually suitable for short-term projections since it provides insight using just the previous sales data.

Forecasting quarterly sales for a retail company could be a well-fitting example for the use of time series or trend analysis methods. The retail firm can analyse its historical sales data over the past several years to identify patterns such as seasonal fluctuations, cyclical trends, and overall growth or decline in sales. They can then forecast future sales for upcoming quarters based on these patterns. Let’s say the firm witnesses a consistent peak in sales during the holiday season and a dip during the first quarter of each year. With this information in their hands, the company can anticipate similar trends in the upcoming year. This forecast will help them adjust their inventory levels, marketing strategies, and staffing accordingly.

Moving Average

Moving average is a statistical method in which the normal average is considered as the basic calculation for forecasting seasonal demand. To make your average move over time, you need to remove the oldest values from the data and add new values.

For instance, you could use your week-by-week revenue data to forecast revenue for the coming week using the moving average method.

Exponential Smoothing

This method considers past data but gives more importance to recent observations. It allows you to make essentially data-driven forecasts without the need to examine multiple sets of data.

If you have the right tools, the exponential smoothing method can prove to be really effective for short-term forecasting.

Adaptive Smoothing

The adaptive smoothing method uses multiple variables to make a forecast. It helps you to dive deeper into changes over a period of time and pinpoint particular patterns.

By using this method, you can concentrate on specific variables and make wiser decisions.

That’s all. By now, you must have a clear understanding of all the qualitative and quantitative forecasting methods. But which one is the best?

The Best Of All Qualitative & Quantitative Forecasting Methods

While there is no one best method of supply chain forecasting, it is important to note that short-term forecasts are generally more accurate than long-term forecasts.

In fact, it is also true that all of these qualitative and quantitative forecasting methods have some or other errors due to the underlying assumptions.

In a nutshell, the type of method you should use depends on your objectives. As the qualitative methods rely on subjective opinions, we suggest that you consider the quantitative methods to be a bit more reliable.

Strengthen Your Supply Chain

By outsourcing your eCommerce warehousing and fulfillment operations to Shiprocket Fulfillment, you can store your inventory closer to your customers in a PAN India network of fulfillment centers.

As a result, you can deliver your orders three times faster and easily manage a surge in demand. Strengthen your supply chain with efficient logistics. Get in touch with our fulfillment experts today.