You already know that tracking data is essential for running your eCommerce business. However, tracking some data points can be more important than others. You need to watch your performance metrics closely in order to stay focused on areas of improvement and keep a close eye on your overall financial health. What drives performance in any business? Revenue. Knowing the amount of revenue produced from the products you sell is crucial to the success of your business. This metric shows how much you’ve sold, how well you’ve priced your products, and whether your business is growing or shrinking. If your goal as an eCommerce business owner is to boost your revenue, then you need to understand ARPU. It’s far more than just an average; this KPI encompasses multiple vital metrics that can give you a clear overview of how your business stands. Keep in mind the benefits of accurately measuring and improving it. Let’s look at average revenue per unit, how you can calculate it, and its importance for your eCommerce business.

What is Average Revenue Per Unit?

The average revenue per unit (ARPU) is a vital eCommerce and inventory management KPI measure. It tells you how much you’re earning on average from selling one unit of inventory and can also be used to measure the amount of revenue you generate from each subscriber or user.

ARPU is employed mainly by media and streaming companies, phone carriers, internet service providers, and software-as-a-service companies. It can also be used for subscription box services and membership-based eCommerce businesses. Consequently, it’s an essential metric for managing inventory management, but it’s also helpful in calculating performance from individual product sales that can’t be measured.

The Formula of Average Revenue Per Unit

The following formula is used to calculate your total revenue divided by the total number of units sold:

Average Revenue Per Unit = Total Revenue / Total Units Sold

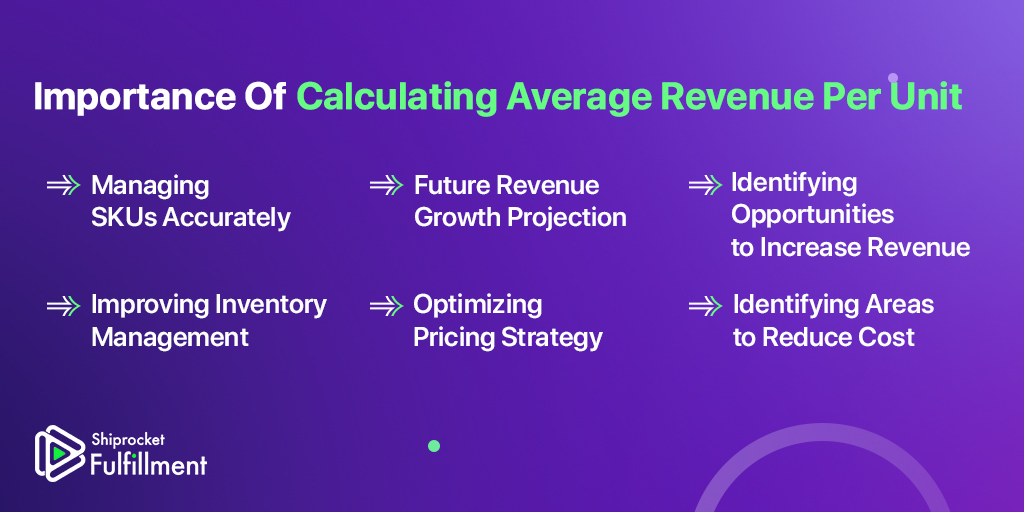

Importance of Calculating Average Revenue Per Unit

There are many benefits to calculating your average revenue per unit. Improved profitability, increased revenue, and better decision-making is all-inclusive.

Managing SKUs Accurately

You can improve your SKU management process by using SKU tracking with your average revenue per unit. This gives insight into the profitability, how fast each SKU is selling, and which ones need step-ups in a promotion or which to cut altogether. SKU rationalization is a process where you identify, replace and discontinue SKUs that aren’t profitable. Using ARPU can help optimize the process because it will allow you to understand what items to discontinue quickly. For example, it could be discontinued if an item has a low SKU count and ARPU. This will allow you to save time on procurement and reduce the cost of holding the SKU.

Future Revenue Growth Projection

Businesses need to make projections to plan and strategize. Without this, you can’t accurately predict the future. The average revenue per unit plays a vital role in helping businesses project revenue growth for the future. This calculation involves multiplying your ARPU with your projected acquisition and retention numbers. Accurately forecasting your revenue enables you to manage your credit flow better and plan. If you predict in advance, you can determine whether you’ll have to take out more credit or just have access to capital. Accurately forecasting also allows you to forecast future demand, which is essential for production and procurement.

Identifying Opportunities to Increase Revenue

Revenue per unit is a great way to identify opportunities for revenue growth. The metric tells you which products are good at generating revenue. You might want to include popular items in smaller box subscriptions to increase revenue. You can also bundle slow-selling SKUs with higher ARPUs. Fulfillment providers like Shiprocket Fulfillment can help you bundle orders and ship them faster to customers.

Improving Inventory Management

You can measure your ARPU by finding the average of your revenue for a unit. Your ARPU is relevant because it tells you how much profit you are getting from one item. You want to work with a higher ARPU if you’re going through less supply and more inventory-holding costs. When you have too much inventory, the rise in risk leads to dead inventory sitting on your shelves; this decreases revenue per unit because the excess inventory is more expensive. Inventory management makes it easier to see if any slow-moving SKUs need to be discontinued and identify SKUs with better profitability and inventory turnover. This will allow you to determine the minimum order quantity for each unit, which is essential for maintaining optimal inventory levels across warehouses and fulfillment centers.

Optimizing Pricing Strategy

Calculating your average revenue per unit is an excellent way to check your pricing strategy. If you notice that your prices are too low, you may need to reassess the pricing of your products in order to optimize for profitability. For eCommerce businesses that are scaling, it is vital to have a pricing system that changes over time. Knowing your average revenue per unit is essential so you can set a baseline and make decisions. Ensure that your pricing strategy is well thought out and considers how your competitors are doing. With careful planning and consideration, you can increase prices without losing customers.

Identifying Areas to Reduce Cost

Understanding your ARPU is essential because you may need to adjust the number of items you purchase to improve it. For example, if you find that your cost of inventory is reducing your revenue, you may want to reduce the number of items in your store and try re-evaluating how much money that frees up for customer service. When looking at your ARPU and the costs incurred, there are many opportunities to lower your costs. You should examine your ARPU in coordination with the expenses incurred.

In some cases, hidden inefficiencies like excess inventory, poor demand planning, or delayed order fulfillment can result in revenue leakage, where your business loses potential income without it being immediately obvious. Identifying and plugging these leaks is crucial for long-term profitability.

If the cost of holding inventory is affecting your average revenue per unit, it might be time to take action – like reducing inventory levels or better forecasting demand.

Average Revenue Per Unit vs. Customer Lifetime Value

Sometimes people get confused between ARPU and the LTV. While the two metrics have a deep connection, they have different purposes. A unifier for this difference is that ARPU focuses primarily on how much revenue you generate from an individual customer. In contrast, LTV focuses on how much revenue you will make from future profits from that customer.

Customer lifetime value calculates how much each customer is worth over a certain period.

Meanwhile, average revenue per unit is used for measuring the revenue generated from making sales from inventory on a unit basis.

The factors to calculate LTV include refund rates and transaction fees. These elements determine LTV by using this formula:

Customer Lifetime Value = (Lifetime Spend – Variable Costs) / Total Number of Customers Acquired

Final Thoughts

When it comes to a subscription business model, measuring ARPU is critical. It’s the number that will allow you to make intelligent decisions about pricing and future marketing efforts. As you run your subscription business, take the time to track your ARPU to see how your marketing efforts are impacting your bottom line.