All the products manufactured in this world are made of several other components. These other components can also be manufactured from other components. For example, think of a car. It looks like a whole product but if you actually look at it, it has machines, seats, mirrors, and a lot of other components. These components themselves are made of other components.

The cost of the products depends on what was required to make it, including raw material, labor, and overhead costs, and this is what Work-in-Progress is. Thus, WIP or Work-in-progress inventory is crucial for a business.

In this blog, we shall discuss, what is Work-in-progress inventory, the different types of inventory, and the difference between work-in-progress and work-in-process.

What is the Work-In-Progress Inventory – Definition

WIP inventory is used to refer to the partly finished material. Essentially, it is the cost of the unfinished products currently in production. It is an asset for a company and is mentioned in the balance sheet as well. For a business, that sells customized or hand-made products, WIP inventory becomes all the way more important than a business that purchases a finished product from a manufacturer.

WIP inventory, raw materials, and finished goods are different from each other. To help you understand the difference, we have discussed the types of inventory.

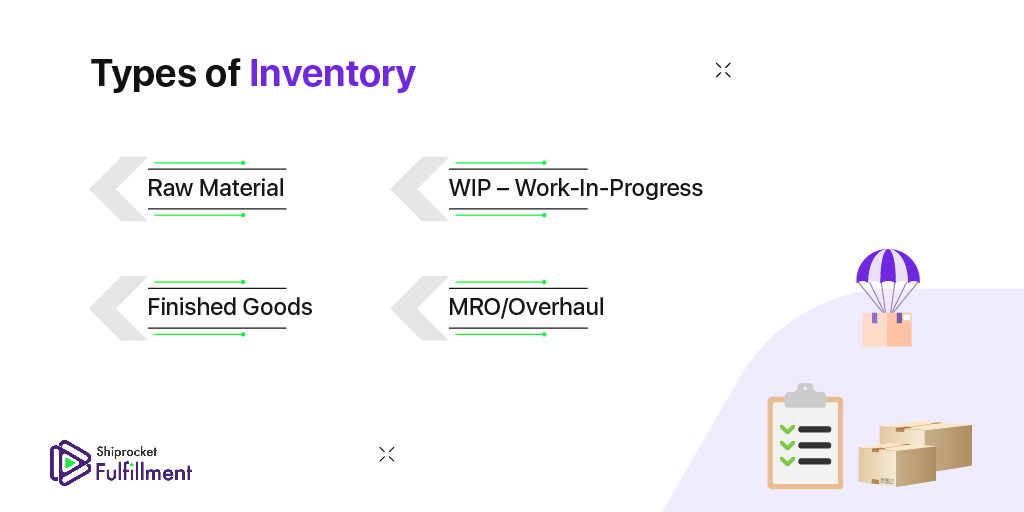

Types of Inventory

Understanding different types of inventory are crucial to make sound financial and production choices. There are four main types of inventory, namely:

Raw Material

Raw materials are the materials that are required to turn the inventory into the final product. For example, nuts and bolts might be required to make the final product, i.e., a machine. Or if you sell food, vegetables or spices can be a raw material for you.

WIP – Work-In-Progress

Work-in-progress inventory is the stock that is being worked on. If we talk cost-wise, WIP inventory includes not just the raw material but the labor and overhead cost as well. The inventory under this category is the part of something bigger – the end-product. If you sell medicines, their packaging can be work-in-progress. You cannot sell medicines without proper packaging.

Finished Goods

Finished goods are the final product. It is the most straightforward of all the types of inventories. It is the inventory that you put on the shelf in your shop to sell, that you put on sale on your website. They are the finished goods that are ready to sell. Simply put, any product or inventory that is ready to be sold comes under this category.

Notably, in the above-discussed example, nuts and bolts can be a raw material for a business that is selling machines. But they can also be the final products for a business that sells nuts and bolts only. It just depends on the business that is selling the products.

MRO / Overhaul

MRO means maintenance, repair, and operating supplies. Many people don’t consider MRO inventory as a type of inventory. MRO is the inventory that is required to assemble, finish, and sell the finished products. So, gloves required to paint the product can be considered MRO. Or MRO can be also pens, papers, and highlighters required in an office.

Important Terms Related to WIP Inventory

It is a bit complex procedure to determine the cost of WIP inventory. Before trying to evaluate their value, it is important that you understand a few terms related to WIP inventory:

Beginning WIP Cost

The beginning WIP inventory cost is the cost of the assets (WIP inventory) in the previous accounting section of the balance sheet. To calculate it, you need to determine the value of the WIP inventory in the previous period and carry it forward as assets in the financial year.

Manufacturing Process Costs

The manufacturing process cost is associated with the cost incurred while manufacturing a finished product. This includes overhead costs, raw material, and labor. The higher the WIP inventory is used in the manufacturing process, the higher the value is of raw material and labor. This simply affects the total cost of manufactured goods. Its formula is:

Raw Material + Labor Cost + Overhead Cost = Manufacturing Cost

Cost of Manufactured Goods

As discussed above, the cost of manufacturing includes the cost of raw material, labor, and overhead cost. It is the cost incurred to manufacture the final product. COMG is required to calculate the value of WIP inventory. So, the COMG is the addition of manufacturing cost and beginning WIP inventory cost less ending WIP inventory cost. The formula for it is:

Manufacturing Cost + Beginning WIP Inventory – Ending WIP Inventory = COMG

Work In Progress VS Work In Process

Many people refer to both the terms interchangeably, but knowing the differentiation is necessary. Work in progress inventory, as discussed above, is the cost of unfinished inventory. It includes the cost of raw material, labor, and overhead. The WIP cost is listed under the assets in the balance sheet at the end of the financial year.

On the other hand, work in the process represents partially completed goods. It is the inventory that is incomplete and still in progress. Work in process is essentially referred to as the products that move from raw material to finished product, they are the unmanufactured products in progress.