Technology has simplified the entire eCommerce logistics process. The data flow and knowledge sharing that have been enabled due to information and technology integration have made it much easier to optimize the eCommerce fulfillment supply chain. However, you need to be up-to-date with all the recent changes; otherwise, the whole sea of terminology can take you by storm. Even though eCommerce logistics has become easier, documentation can still be difficult. The E-Way bill is one such example that you must take care of while shipping your goods. Let’s look at what an E-Way bill is and the other aspects that surround it.

What is an E-Way Bill?

The E-Way bill is a receipt or document generated by a seller (consignor) when the transportation of goods is done by air/railways/road via a hired or own logistics medium.

It is a mandatory document that a person who is carrying any consignment of goods greater than Rs.50,000 INR must-have.

E-Way Bill Under The GST Regime

Under the GST regime, the E-Way bill is an electronic document generated on the GST portal that shows the evidence of the movement of goods.

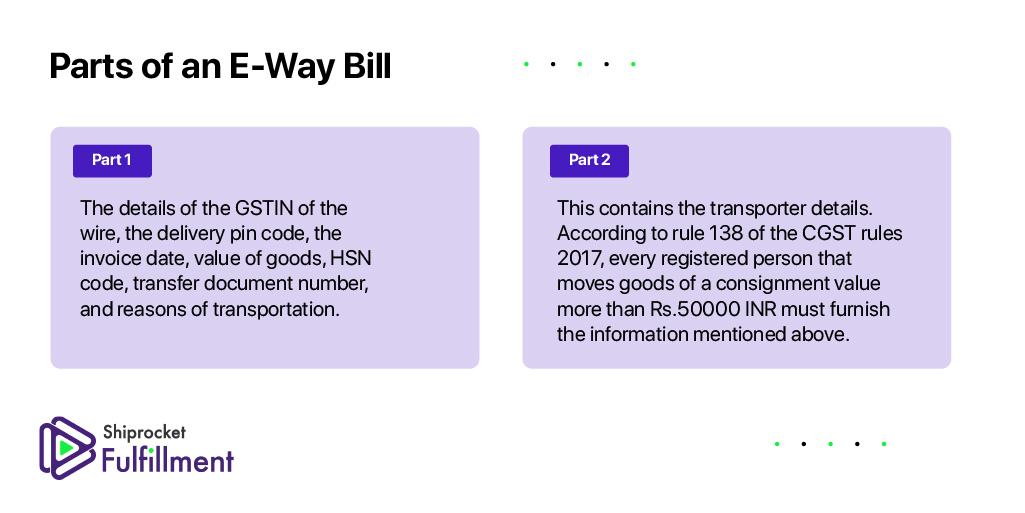

The components of the E-Way bill include:

- PART A – The details of the GSTIN of the wire, the delivery pin code, the invoice date, value of goods, HSN code, transfer document number, and reasons of transportation.

- PART B – this contains the transporter details. According to rule 138 of the CGST rules 2017, every registered person who moves goods of a consignment valued at more than Rs.50000 INR must furnish the information mentioned earlier.

Why is an E-Way Bill Required?

The E-Way bill is important because it ensures that the goods being transported comply with the GST law. It is also useful to track the movement of goods and keep a tab on tax evasion.

Who Needs an E-Way Bill?

The evil needs to be generated by the seller who is shipping goods via their own or hired conveyance. The transportation mode could be air, road, or railway. If consignments are being shipped via road, the transporter must generate the E-Way Bill.

How Can You Obtain an E-Way Bill?

The steps to obtain an E-Way bill are as follows –

- Go to ewaybill.nic.in

- Here, enter your username, password, captcha, and login

- Under the e-way bill option, click on generate new

- Enter the

- Transaction type – Inward or outward

- Sub type – Supply, import, export, job work, SKD/CKD, own use, exhibition, etc.

- Document type- Invoice / Bill/ challan/ credit note/ Bill of entry or others

- Document no. – Document/invoice number

- Document date – Date of Invoice or challan or Document

- Sender or receiver’s address

- Item details –

- Product name

- Description

- HSN Code

- Quantity,

- Unit,

- Value/Taxable value

- Tax rates of CGST and SGST or IGST (in %)

- Tax rate of Cess, if any charged (in %)

- Transporter details

- Mode of transport (road/rail/ship/air)

- Approximate distance covered

- Submit the details

- Your E-Way bill will be generated

- Go to Print EWB & print the document

Validity of the E-Way Bill

The validity of the E-Way bill for different segments is as follows –

| Type of conveyance | Distance | Validity of EWB |

| Other than over-dimensional cargo | Less than 100 km | 1 Day |

| For every additional 100 km or part thereof | additional 1 Day | |

| For over-dimensional cargo | Less than 20 km | 1 Day |

| For every additional 20 Kms or part thereof | additional 1 Day |

When is an E-Way Bill Not Required?

An E-Way bill is not required under the following circumstances –

- Transportation mode is a non-motorized vehicle

- Goods transported under Customs supervision or customs seal

- Goods are transported by rail where the Consignor of goods is the Central Government, State Governments, or local authority.

- Goods specified as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

- Transportation of empty transport containers

Final Thoughts

The E-Way bill is an important document for your eCommerce business. Make sure you have all your operations in order and procure this document on time before you ship high-value items.